Exness - Sàn giao dịch Forex & CFD trực tuyến

Giao dịch với nhiều công cụ trên thị trường tài chính toàn cầu, với mức giá ổn định và tin cậy nhất trong ngành.

Khớp lệnh nhanh

Spread ổn định

Rút tiền tức thì

Không phí hoa hồng

Những con số ấn tượng của Exness

-

Số lượng khách hàng500.000+Khách hàng đang hoạt động tại Exness tính đến tháng 6 năm 2023

-

Khối lượng giao dịch3.3 nghìn tỷ USDTổng khối lượng giao dịch trong tháng 6 năm 2023

-

Tiền rút của khách hàng1.3 tỷ USDTiền rút của khách hàng trong quý 2 năm 2023

Ưu điểm của sàn giao dịch Exness

Cung cấp sản phẩm/dịch vụ đa dạng

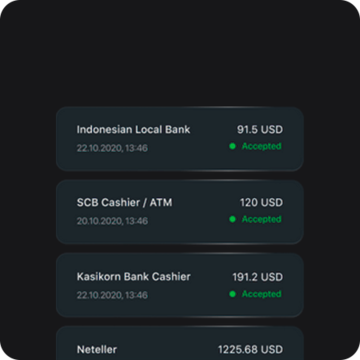

Phương thức thanh toán linh hoạt, an toàn

Nền tảng giao dịch hiện đại

Chênh lệch thấp và ổn định

Khớp lệnh nhanh chóng và đáng tin cậy

Hỗ trợ khách hàng 24/7 bằng nhiều ngôn ngữ

Các công cụ giao dịch của Exness

Forex

Hàng hoá

Cổ phiếu

Các chỉ số

Tiền kỹ thuật số

Giao dịch hơn 100 cặp tiền tệ chính. phụ, hiếm với đòn bẩy linh hoạt, phí giao dịch thấp và ổn định

Giao dịch với các kim loại quý như vàng, bạc hoặc các năng lượng phổ biến như dầu thô, khí đốt tự nhiên

Dễ dàng tiếp cận thị trường cổ phiếu toàn cầu, với chênh lệch thấp và ổn định, không mất phí hoa hồng, miễn phí phí qua đêm.

Đa dạng hóa danh mục đầu tư với các chỉ số cổ phiếu đến từ Hoa Kỳ, Vương quốc Anh, Đức, Nhật Bản và Trung Quốc.

Giao dịch với các loại tiền kỹ thuật số phổ biến hiện nay như Bitcoin, Ethereum, Litecoin, và hơn thế nữa.

Nền tảng giao dịch Exness

Ứng dụng Exness Trade

Giao dịch dễ dàng với hơn 200 công cụ, bao gồm forex, tiền kỹ thuật số, cố phiểu, chỉ số và năng lượng.

Ứng dụng Exness Trade được thiết kế dành riêng cho các nhà giao dịch thường xuyên, với nhiều tính năng nổi bật như: dễ dàng quản lý tài khoản và nạp/rút tiền ngay trên điện thoại chỉ với vài thao tác, theo dõi tin tức, cập nhật thị trường liên tục và hỗ trợ chức năng giao dịch hoàn thiện.

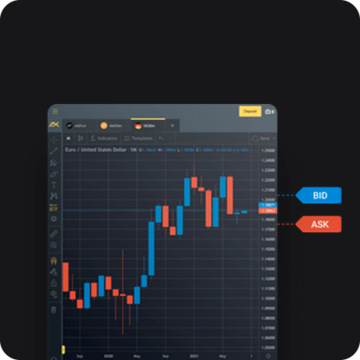

Exness Terminal

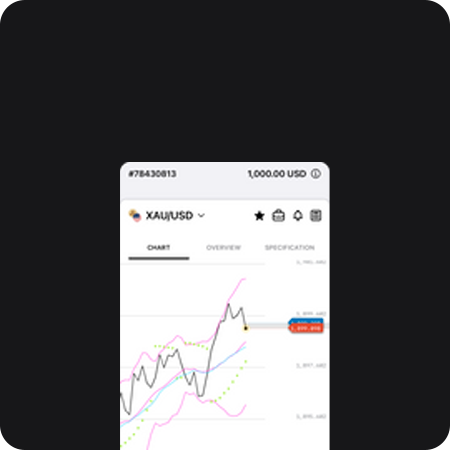

Truy cập chức năng biểu đồ tốt nhất trong ngành, với giao diện trực quan, công nghệ biểu đồ tiên tiến, mang đến trải nghiệm giao dịch toàn diện.

Exness Terminal là một ứng dụng web HTML 5 được phát triển bởi các nhà thiết kế và lập trình viên của Exness. Exness Terminal cung cấp hơn 50 công cụ vẽ, 100 chỉ báo kỹ thuật và hỗ trợ đầy đủ tính năng tương tự như MT5. Biểu đồ được cung cấp bởi TradingView. Đây chính là nền tảng web đáng tin cậy và tối ưu để giao dịch hơn một trăm CFD phổ biến nhất.

MetaTrader 4 Exness

Giao dịch CFD trên hơn 200 công cụ, bao gồm: forex, kim loại, năng lượng, cổ phiếu, chỉ số và tiền kỹ thuật số

MetaTrader 4 (MT4) là nền tảng giao dịch phổ biến được phát triển bởi MetaQuotes. Đây là nền tảng giao dịch phù hợp với nhà giao dịch ở mọi cấp độ, với nhiều tính năng nổi bật như: hỗ trợ 6 loại lệnh chờ và 2 loại khớp lệnh (khớp lệnh thị trường và tức thời). Tích hợp sẵn 30 chỉ báo kỹ thuật, 23 đối tượng phân tích.

Ngoài ra, nhà đầu tư có thể tự động hóa các hoạt động giao dịch và phân tích trên thị trường tài chính nhờ robot giao dịch và hệ thống cố vấn (EA) trên MT4.

MetaTrader 5 Exness

MetaTrader 5 là thế hệ tiếp theo sau thành công của MetaTrader 4, cho phép nhà đầu tư giao dịch forex, CFD và cả hợp đồng tương lai.

MetaTrader 5 là nền tảng giao dịch có nhiều tính năng nâng cao hơn so với MT4. Hỗ trợ đầy đủ các công cụ phân tích kỹ thuật và phân tích cơ bản, bao gồm: 38 chỉ báo, 22 công cụ phân tích, 46 đối tượng đồ họa.

Ngoài ra, các nhà giao dịch có thể theo dõi biến động giá theo thời gian thực trên biểu đồ trong khoảng thời gian từ 1 phút đến 1 tháng. Và có thể giao dịch tự động trên MT5, sử dụng robot giao dịch hoặc Hệ thống cố vấn (EA).

Các bước để bắt đầu giao dịch tại Exness

Bắt đầu giao dịch

Truy cập vào website chính thức của Exness, nhấn nút "Mở tài khoản" và điền đầy đủ thông tin theo yêu cầu. Sau đó thực hiện xác minh tài khoản Exness để có thể bắt đầu giao dịch tại đây.

Exness cung cấp nhiều phương thức nạp tiền linh hoạt như: chuyển khoản ngân hàng, thẻ Visa/Mastercard, Ngân lượng, Ví điện tử.... Bạn chỉ cần chọn phương thức phù hợp và làm theo hướng dẫn.

Lựa chọn nền tảng giao dịch Exness MetaTrader 4 (MT4) hoặc MetaTrader 5 (MT5), sau đó tải ứng dụng về máy tính, điện thoại. Tiếp theo, đăng nhập tài khoản Exness của bạn và bắt đầu giao dịch.

1

2

3

Nạp tiền vào tài khoản

Các loại tài khoản Exness

Đây là loại tài khoản phù hợp với mọi nhà giao dịch, bao gồm cả người mới. Điểm nổi bật của tài khoản Standard là không yêu cầu tiền ký quỹ tối thiểu, tốc độ khớp lệnh thị trường, không phí hoa hồng, chênh lệch ổn định từ 0.3 pip và không báo giá lại.

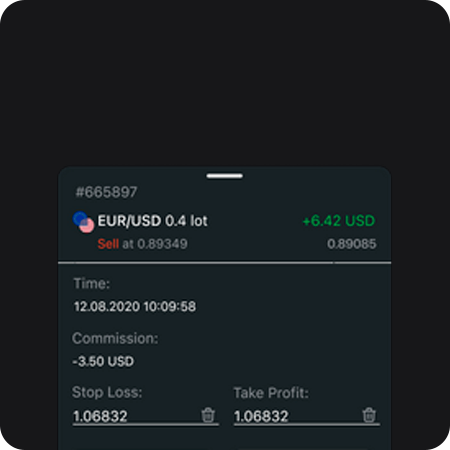

Điểm nổi bật: chênh lệch thấp nhất (spread từ 0.0 pip), phí hoa hồng cố định lên đến $3.50 mỗi lô/ 1 chiều, khớp lệnh thị trường. Tài khoản Raw Spread phù hợp với các nhà giao dịch có kinh nghiệm, những trader giao dịch lướt sóng, giao dịch tròng ngày...

Đây là tài khoản đáp ứng nhu cầu của các nhà giao dịch giàu kinh nghiệm, với Spread chỉ từ 0.0 pip, phí hoa hồng $0.2 mỗi lô/ 1 chiều, tốc độ khớp lệnh thị trường và không báo giá lại. Để mở tài khoản Zero Exness, trader cần ký quỹ tối thiểu 200$

Điểm nổi bật của tài khoản Pro là tốc độ khớp lệnh tức thời, chênh lệch thấp chỉ từ 0.1 pip, không phí hoa hồng và hỗ trợ đòn bẩy không giới hạn. Tài khoản Pro phù hợp với trader giao dịch lướt sóng, nhà giao dịch trong ngày và nhà giao dịch thuật toán.

Sự khác biệt giữa tài khoản thực và Demo của Exness

Sự khác biệt giữa tài khoản Demo và tài khoản thực của Exness chính là bạn sẽ giao dịch bằng tiền thật trên tài khoản thực, còn trên tài khoản Demo bạn sẽ sử dụng tiền ảo để giao dịch. Do đó, bạn sẽ không thể nạp hay rút tiền trên tài khoản Demo.

Tuy nhiên, các điều kiện giao dịch trên hai loại tài khoản này hoàn toàn giống nhau. Vì thế, bạn có thể sử dụng tài khoản Demo để làm quen với nền tảng giao dịch Exness hoặc thử nghiệm các chiến lược giao dịch mới.

Các công cụ hỗ trợ độc quyền của Exness

Lịch kinh tế

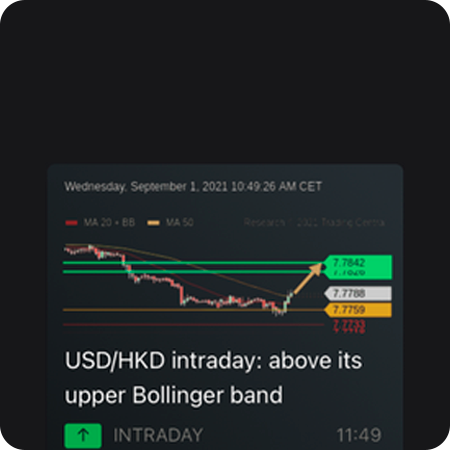

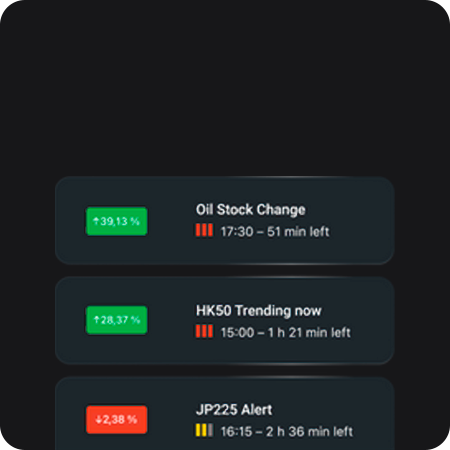

Tín hiệu và tin tức thị trường

Biểu đồ nâng cao

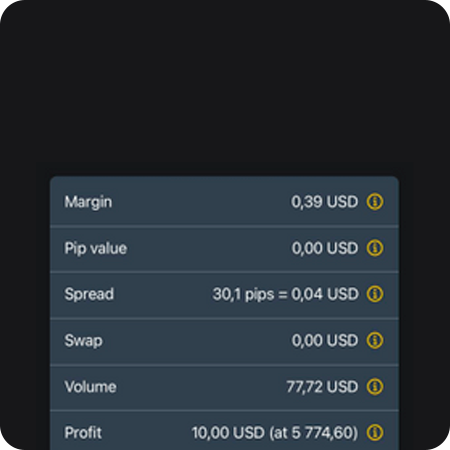

Máy tính tài chính

Lịch sử thay đổi giá

Tại sao nên chọn sàn Exness?

15 năm kinh nghiệm trong lĩnh vực môi giới giao dịch Forex & CFD trên toàn cầu

Hỗ trợ khách hàng 24/7 bằng 16 ngôn ngữ khác nhau

Phương thức thanh toán linh hoạt, nạp rút tiền tức thì chỉ trong vài giây

Được cấp phép và quản lý bởi nhiều cơ quan tài chính uy tín: FCA, FSC, CySEC, FSA, FSCA, CBCS

Giấy phép sàn Exness

Exness (SC) Ltd là Nhà giao dịch chứng khoán được đăng ký tại Seychelles, được Cơ quan dịch vụ tài chính (FSA) cấp phép với số giấy phép SD025.

Exness B.V. là Công ty trung gian chứng khoán đăng ký tại Curaçao, được Ngân hàng Trung ương Curaçao và Sint Maarten (CBCS) cấp phép với giấy phép số 0003LSI.

Exness (VG) Ltd được Ủy ban Dịch vụ Tài chính (FSC) cấp phép hoạt động tại BVI, với số giấy phép SIBA/L/20/1133.

Ngoài ra, Exness cũng là thành viên của Ủy ban Tài chính - một tổ chức quốc tế chuyên giải quyết vấn đề khiếu nại và tranh chấp trên thị trường ngoại hối. Quỹ bồi thường được tài trợ bởi Ủy ban Tài chính thông qua việc phân bổ 10% phí thành viên hàng tháng. Và sẽ dùng để chi trả cho các quyết định của Ủy ban Tài chính, với mức bảo hiểm lên đến €20,000 cho mỗi khách hàng.

General Risk Warning

CFDs are leveraged products. Trading in CFDs carries a high level of risk thus may not be appropriate for all investors. The investment value can both increase and decrease and the investors may lose all their invested capital. Under no circumstances shall the Company have any liability to any person or entity for any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to CFDs.